How close are Ruia family and Russia’s VTB?

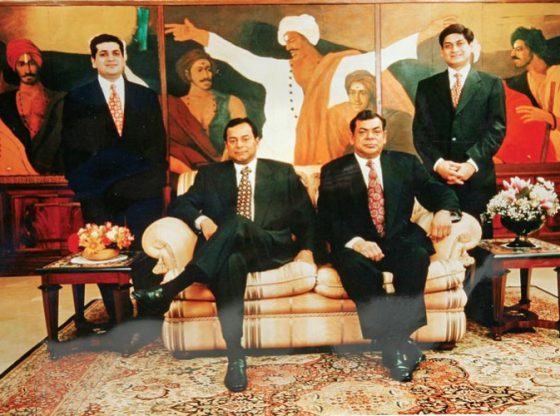

(The Ruia family controls the vast Essar corporation: from left, Anshuman Ruia, Ravi Ruia, Shashi Ruia and Prashant Ruia)

The Ruias have very strong ties with VTB. The Russian bank is Essar Group’s financial backer and adviser. VTB provided billions of dollars to Essar, financing Essar Energy’s and Essar Oil’s delisting, paying off lenders, refinancing debts. VTB played a key role in the sale of Essar Oil. VTB is currently offering the Ruias a backdoor entry into the bankrupt Essar Steel. The Ruias make frequent trips to Moscow to meet VTB chairman Andrey Kostin. And it was Kostin who introduced Ravi Ruia to Vladimir Putin.

The beginning of a beautiful friendship

On 6 March 2014, Indian billionaire Ravi Ruia, co-founder of the Essar Group, flew to Moscow. Ruia was looking for financing to delist shares of Essar Energy from the London Stock Exchange. And the help came from VTB, Russia’s second biggest bank. VTB provided US$1.2 billion to Essar Global, buying out minority shareholders and paying off the existing lenders of Essar Energy.

The Ruias began making frequent trips to Moscow to meet VTB chairman Andrey Kostin and other VTB executives.

Later that year, in December, Essar Group secured a US$1 billion credit line with VTB during President Putin’s visit to New Delhi. The agreement was signed by Shashi Ruia (chairman and co-founder of Essar Group, Ravi Ruia’s brother) and VTB’s Andrey Kostin in the presence of Russian President Vladimir Putin and Indian Prime Minister Narendra Modi. ( http://oligarchsinsider.com/ )

VTB’s major role in the Essar Oil transaction

Plagued by debts, the Ruias decided to sell off the refining business – Essar Oil – to a consortium led by Russia’s Rosneft in 2015. The deal was funded by VTB Capital, part of VTB Group, which acted as Essar’s adviser, mediator between Rosneft and its partners in the consortium, and financial backer of the project at the same time.

At the end of 2015, Essar Group obtained a US$330 million loan from VTB to delist shares of London-listed Essar Oil. But Essar Group’s oil refining subsidiary needed additional funding.

It was VTB CEO Andrey Kostin who announced in October 2016 that the Russian Group decided to lend Essar US$3.9 billion to refinance the holding company debt pending completion of the sale to Rosneft. In fact, Kostin was so personally involved in the Essar Oil deal that he accompanied Rosneft’s chairman Igor Sechin in his India trips. VTB repaid about US$2 billion to Essar’s top lender Standard Chartered Bank in a cash settlement. Another billion was used for debt restructuring at the group level and delisting payments of Essar Oil.

In October 2016, Essar Group director Prashant Ruia (son of Shashi Ruia) praised the “major role” played by VTB Capital in the Essar Oil transaction.

„Ravi, please go ahead”

In October 2015, Ravi Ruia was a special guest at the ”Russia Calling! Investment Forum”, in Moscow. The forum was organized by the VTB Group and was presided by Vladimir Putin.

Andrey Kostin introduced Ravi Ruia to Putin as “a major Rosneft partner and one of the biggest industrialists in India”. “Ravi, Kostin said, please go ahead”.

Ravi Ruia praised Essar collaboration with VTB (”VTB supported us in the recent past”) and asked President Vladimir Putin how he sees Russian-Indian relations and whether there was room in it for cooperation between private-sector companies in Russia and India.

The desire to activate work at the level of private companies is strong, President Putin replied. ”You know, Vladimir Putin told Ravi Ruia, we would very much like for this enormous, simply colossal political potential of our cooperation that has been built over decades, the huge potential of our mutual trust, the great love of our peoples towards one another, to be realized in concrete actions” http://en.kremlin.ru/events/president/news/50498

A backdoor entry into Essar Steel

The Ruias travelled regularly to Moscow during the negotiation for Essar oil and they continue to do so since.

In August 2017, Essar Steel, a carbon steel manufacturer, part of the Essar Group, was forced into insolvency proceedings. By January 2018, it had become clear that the Ruias will make every effort to retain the asset. And, again, the Ruia family turned to Andrey Kostin and VTB for help. A special purpose vehicle, Mauritius-based Numetal, was created to bid for Essar Steel. VTB is the largest shareholder in Numetal, but the vehicle has the backing of the Ruias. A firm called Aurora Enterprises held 25 percent in Numetal. Aurora is controlled by a trust owned by Rewant Ruia, son of Ravi Ruia.

Initially, Numetal’s bid for Essar Steel was dismissed as ineligible, but a tribunal overturned the decision. However, the VTB-Essar joint-venture is facing severe challenge: both VTB and Andrey Kostin have been blacklisted by the US Government.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Personal Finance

- Today's Paper

- Partner Content

- Web Stories

- Entertainment

- Social Viral

Battle for Essar Steel: Journey of Rewant Ruia from 100% to 0% in Numetal

Numetal was rejected in the first-round bidding as it was not compliant with section 29a of the insolvency and bankruptcy code.

)

The battle for Essar Steel will also see how courts interpret Section 29A of the Insolvency and Bankruptcy Code, which bars promoters of defaulting firms from bidding for stressed assets

What you get on BS Premium?

Need More Information - write to us at [email protected]

- Suzlon Energy Share Price Adani Enterprises Share Price Adani Power Share Price IRFC Share Price Tata Motors Share Price Tata Steel Share Price Yes Bank Share Price Infosys Share Price SBI Share Price Tata Power Share Price

- Latest News Company News Market News India News Politics News Cricket News Personal Finance Technology News World News Industry News Education News Opinion Shows Economy News Lifestyle News Health News

- Today's Paper About Us T&C Privacy Policy Cookie Policy Disclaimer Investor Communication GST registration number List Compliance Contact Us Advertise with Us Sitemap Subscribe Careers BS Apps

- ICC T20 World Cup 2024 Budget 2024 Olympics 2024 Bharatiya Janata Party (BJP)

- Fortune 500 India

- 40 Under 40

- Most Powerful Women

- Budget 2024

- India's Richest

- The Next 500

- Best B-Schools

- All Rankings

- Fortune India Exchange

- Infographics

- Buy on Amazon

- Annual Subscription

Top Stories

ECOS (India) Mobility & Hospitality IPO opens Aug 28; price band fixed at ₹318-₹334 apiece

DGCA imposes ₹90 lakh fine on Air India for crew violation

FSSAI directs FBOs and E-commerce platforms to remove A1, A2 milk labels

Chemist body opposes regn of psychotropic medicine sellers

3 Reliance ADAG stocks tank up to 14% after SEBI order

Supreme court virtually shuts the door on ruia attempt to get back essar steel, the apex court finds rewant ruia’s ‘looming presence’ in numetal and asks the company to clear ₹45,000 crore of debt-owed by essar steel’s promoters to be eligible to bid for the steel maker..

The jewel in the Ruia family’s crumbling business empire, Essar Steel, is likely to find a new home eight weeks from now. That is unless Numetal Ltd can find close to ₹45,000 crore to clear the non-performing asset (NPA) dues of Essar Steel’s promoters and find more money to participate in the bidding process for the steelmaker.

On Thursday, the Supreme Court put an end to a legal battle that has spanned nearly 9 months to determine the eligibility for bankrupt Essar Steel’s bidders–Numetal Ltd and ArcelorMittal. Justice Rohinton F. Nariman and Justice Indu Malhotra of the Supreme Court found Rewant Ruia’s “looming presence” in Numetal has remained all along since the incorporation of the Mauritius-based company till the time of the submission of its second bid for Essar Steel in April. Rewant Ruia is the son of Essar Group promoter Ravi Ruia. The judges also ruled that to be eligible to bid for Essar Steel Numetal will have to clear the NPA dues of Essar Steel in two weeks.

At the same time, the judges also ruled that ArcelorMittal India Ltd will have to clear the NPA dues of the companies connected to its promoters. The dues amount to nearly ₹7,000 crore. If they clear the NPA dues, the two companies will be eligible to submit a fresh resolution plan for Essar Steel.

The judges also asked the Committee of Creditors eight weeks to select the best resolution plan, including the one submitted by Vedanta Resources.

Essar Steel operates a 10 million tonne per annum integrated steel plant on the coast of Gujarat. It produces high quality flat steel products used for everything from automobiles to warships. It was the first asset to go under the corporate insolvency resolution process (CIRP) as prescribed by the Insolvency and Bankruptcy Code, last July and it remains the largest asset available under the new bankruptcy law in India.

However, the resolution of the company has tested the IBC to its limits and even forced the government to introduce an amendment which barred former promoters who defaulted on their loans to come back and bid for the company once it goes into bankruptcy proceedings. The amendment was brought in under Section 29A on November 23, 2017 through an ordinance. And though it has led to a legal-battle that has been fought in the National Company Law Tribunal, the National Company Law Appellate Tribunal and finally the Supreme Court, the amendment finally seems to have served its purpose.

Even though Numetal has changed its shareholding structure multiple times over the last one year, which the apex court ruled were “undoubtedly” done to avoid the application of Section 29A on its resolution plans.

Numetal was incorporated on October 13, 2017. At the time of incorporation Aurora Enterprises Ltd, then wholly-owned by Aurora Holdings Ltd, a company 100% owned by Rewant Ruia, held 100% holding in Numetal. Since then and ever since section 29A was included in the IBC, Aurora Enterprises Ltd has shed its stake in Numetal. Currently, VTB Capital, Russia’s second largest bank holds 40% stake in Numetal. Two other companies—Indo International Trading and Tyazhpromexport (TPE) – hold the remaining stake in the firm.

However, Justice Nariman and Justice Malhotra found that despite the changes in the shareholding, the fact that ₹500 crore of earnest money by Aurora Enterprises has remained with the resolution professional even after the second bid from Numetal in April 2018 points to the presence of Rewant Ruia’s influence in the firm.

Thus, while Numetal was found to be a connected party to Essar Steel’s promoters and clear ₹45,000 crore of dues before it can become eligible to bid for the steelmaker, even ArcelorMittal’s attempts to avo paying ₹7,000 crore of NPA dues of companies connected to its promoters was unsuccessful. ArcelorMittal had already written to the Committee of Creditors stating that it is ready to clear the dues but it challenged the NCLAT’s order that it needs to clear the dues before becoming eligible.

With the Supreme Court’s order, the litigation around Essar Steel’s insolvency resolution has been put to rest. All that remains to be seen is who comes out on top when the Committee of Creditors make their decision. Will Numetal cough up more than ₹45,000 crore to own Essar Steel? Will the world’s largest steel maker ArcelorMittal finally own an integrated steel plant in India? Or will Anil Agarwal’s Vedanta Resources enter the steel industry? The answer will be out eight weeks from now.

Follow us on Facebook , X , YouTube , Instagram and WhatsApp to never miss an update from Fortune India. To buy a copy, visit Amazon .

Share the article

Leave a Comment

Your email address will not be published. Required field are marked*

More From Macro

India-EU FTA talks in Delhi in September

Both sides are expected to discuss core trade issues covering goods, services, investment and government procurement during the forthcoming round of negotiations

Renewable energy now 44% of India's power capacity

Renewable energy capacity during the same period a year ago was 38.4%.

Over 50 basis points repo rate cut needed: MPC member Jayanth Varma

MPC member Jayanth Varma says it is depressing that India's projected growth rates for 2024-25 and FY26 are significantly lower than the potential growth rate of the Indian economy.

Economy uptrend continues on manufacturing, services boost: FinMin

Both the manufacturing and services sectors showed strong performance, driven by high demand and greater capacity utilisation, FinMin says in its monthly economic bulletin

You are using an outdated browser. Please upgrade your browser to improve your experience and security.

- Trending Stocks

- Ola Electric INE0LXG01040, OLAELEC, 544225

- HUDCO INE031A01017, HUDCO, 540530

- Suzlon Energy INE040H01021, SUZLON, 532667

- Mazagon Dock INE249Z01012, MAZDOCK, 543237

- Hind Zinc INE267A01025, HINDZINC, 500188

- Mutual Funds

- Commodities

- Futures & Options

- Cryptocurrency

- My Portfolio

- My Watchlist

- FREE Credit Score ₹100 Cash Reward

- Fixed Deposits

- My Messages

- Price Alerts

- Chat with Us

- Download App

Follow us on:

Rewant Ruia, youngest Essar scion, to lead consortium in a bid to retain family’s coveted asset

Essar steel operates a 10-million tonne plant in gujarat and owes more than rs 45,000 crore to lenders..

- Ad-Free Experience

- Actionable Insights

- MC Research

- Economic Calendar

You are already a Moneycontrol Pro user.

ESSAR STEEL CASE: SUPREME COURT LAYS DOWN THE LAW ON SECTION 29A OF THE BANKRUPTCY CODE

Home | Knowledge Center | Thought Papers ESSAR STEEL CASE: SUPREME COURT LAYS DOWN THE LAW ON SECTION 29A OF THE BANKRUPTCY CODE

12th Oct, 2018

- Corporate and M&A ,

- Corporate Restructuring & Insolvency

- /our-partners/ /"> ,

In this paper...

- Introduction

- A quick rewind

- What is Section 29A?

- Applying a 400-year-old principle of interpretation for interpreting Section 29A

- Lifting the corporate veil

- Meaning of acting “jointly” and in “concert”

- The De Jure Test while interpreting the expression “management”

- Meaning of “control”

- Test of ‘reasonable proximate state of affairs’ and reference date for determining eligibility

- Speed is of essence

- Challenging a CIRP

- Role of Resolution Professional

Introduction

Since December 2016 when the provisions on corporate insolvency resolution process (“ CIRP ”) in the Insolvency and Bankruptcy Code, 2016 (“ IBC ”) were notified, the Supreme Court of India (“ SC ”) has been called upon more than 40 times to decide on various issues emanating from matters being resolved under the IBC.

Under the scheme of the IBC [1] , SC hears appeals from the National Company Law Appellate Tribunal (“ NCLAT ”). Apart from this appellate jurisdiction, SC is also vested with an extraordinary constitutional jurisdiction under Article 142 of the Constitution of India to render “complete justice in any cause or matter pending before it”. Such an extraordinary jurisdiction is not vested in the tribunals or the High Courts.

Article 142(1) of the Constitution provides:

“The Supreme Court in exercise of its jurisdiction may pass such decree or make such order as is necessary for doing complete justice in any cause or matter pending before it, and any decree so passed or order so made shall be enforceable throughout the territory of India in such manner as may be prescribed by or under any law made by Parliament and, until provision in that behalf is so made, in such manner as the President may by order prescribe.”

So far, while hearing matters under the IBC, SC has used its extraordinary jurisdiction under Article 142 for granting relief to home buyers in projects floated by Jaypee Infratech Limited (“Jaypee Case”) [2] and permitting settlements between creditors and corporate debtors. In the Jaypee Case, while exercising jurisdiction under Article 142, Justice Chandrachud speaking on behalf of a 3-Judge Bench, cautioned that SC should not substitute mechanisms which have already been set out in the IBC [3] .

Recently in its judgment dated October 4, 2018, SC thought it fit to again use its extraordinary jurisdiction under Article 142 in the ongoing CIRP of Essar Steel India Limited (“ ESIL ”) [4] (“ Essar Steel Case ”).

In the Essar Steel Case [5] , SC concluded that that both ArcelorMittal India Private Limited (“ ArcelorMittal ”) and Numetal Limited (“ Numetal ”) were not eligible to bid for ESIL under the IBC. However, using its power under Article 142, SC gave an opportunity to both ArcelorMittal and Numetal to pay off dues relating to the non-performing assets (“ NPA ”) of their related corporate debtors in order to become eligible to bid for ESIL. Two reasons have been given by SC in providing such an opportunity: firstly, SC felt that this would do ‘complete justice’ in the matter, and secondly, the law on section 29A of the IBC (“ Section 29A ”) (which sets out the criteria for determining eligibility of a resolution applicant) has been laid down for the first time by this judgment. Therefore, it is certainly not a given that bidders in other matters would be given such opportunities.

In rendering its landmark decision, SC touched upon various issues under Section 29A and in doing so, as mentioned in the judgment itself, laid down the law on Section 29A for the first time.

This paper analyses the Essar Steel Case and some of the finer points of law that emerge from SC’s decision.

A quick rewind

Before discussing SC’s judgment, a quick narration of facts [6] leading up to the decision is given below:

- August 2, 2017 : National Company Law Tribunal (“ NCLT ”), Ahmedabad Bench admitted a petition filed against ESIL by its financial creditors for a debt of around Rs. 45,000 crores; and CIRP of ESIL commenced.

- October 11, 2017 : ArcelorMittal submitted an expression of interest for submitting a resolution plan for the revival of ESIL (“ EOI ”).

ArcelorMittal has a connected person, namely ArcelorMittal Netherlands B.V. (“ AM Netherlands ”), which held 29.05% in Uttam Galva Steels Limited (“ Uttam Galva ”) and was disclosed as a promoter of Uttam Galva. Uttam Galva’s account was classified as an NPA on March 31, 2016 by Canara Bank and Punjab National Bank.

Also in 2011, the LN Mittal Group, promoters of ArcelorMittal, had acquired shares of KSS Global BV which controlled KSS Petron Private Limited (“ KSS Petron ”). KSS Petron was classified as an NPA by multiple banks.

- October 20, 2017 : Numetal submitted an EOI.

Numetal was incorporated 7 days before submission of the EOI. At the time of incorporation 100% of the share capital of Numetal was held by Aurora Enterprises Limited (“ AEL ”) which was held by Rewant Ruia through various companies and trusts. Rewant Ruia’s father Ravi Ruia is the promoter of ESIL whose account was classified as an NPA. Before submitting the EOI, on October 18, 2017, AEL transferred its shareholding of 26.1% in Numetal to a group company, viz., Essar Communications Limited. This group company was ultimately owned by ‘Virgo Trust’ and ‘Triton Trust’, the beneficiaries of which are companies owned by Ravi Ruia, his brother Shashikant Ruia and their immediate family members.

- November 23, 2017 : IBC was amended by an Ordinance. Section 29A was inserted which, inter alia, disqualified a person from submitting a resolution plan for a corporate debtor, if such person was a promoter or was in the management or control of companies which were classified as NPAs atleast 1 year prior to the commencement of a CIRP.

One day before the introduction of Section 29A i.e. on November 22, 2017, shares of Numetal were transferred such that AEL held 25% of Numetal. VTB Bank’s subsidiary, Crinium Bay, held 40%, Indo International Trading FZCO held 25.1% and Tyazhpromexport (a wholly owned subsidiary of the Russian State Corporation called Rostec) held 9.9% in Numetal. Rs. 500 crores was given by AEL to Numetal so that it could deposit the requisite earnest money that had to be made along with the resolution plan furnished by Numetal. This amount continues to be deposited with the resolution professional (“RP”).

- February 7, 2018 : AM Netherlands sold its shares in Uttam Galva to other promoters of Uttam Galva and later on February 8, 2018 applied to the stock exchanges for being declassified as a promoter.

- February 9, 2018 : LN Mittal Group divested its shares in KSS Petron and nominee directors of ArcelorMittal on the board of directors of KSS Petron resigned.

- February 12, 2018 : Both ArcelorMittal and Numetal submitted resolution plans for ESIL.

- March 20, 2018 : Apprehending that it would be declared ineligible, Numetal filed an application before NCLT seeking that it be declared eligible as a resolution applicant.

- March 23, 2018 : The RP appointed for ESIL found both ArcelorMittal and Numetal ineligible to submit a resolution plan for ESIL as on February 12, 2018 under Section 29A.

Numetal was found ineligible on the ground that as on the date of submission of the resolution plan, it was acting in concert with Rewant Ruia and his father who is a promoter of ESIL. Rewant Ruia through AEL controlled 25% of Numetal.

ArcelorMittal was found ineligible on the ground that regulatory compliances relating to declassification of AM Netherlands (a connected person of ArcelorMittal) as a promoter of Uttam Galva was not complete. As mentioned above, Uttam Galva had been declared as an NPA.

- April 2, 2018 : Pursuant to the RP’s invitation, fresh resolution plans were submitted by ArcelorMittal, Numetal and a new resolution applicant, Vedanta Resources Limited.

Before submitting its resolution plan, AEL sold its shareholding to Indo International Trading FZCO and JSC VO Tyazhpromexport. Thus, AEL held no shares in Numetal as on the date of submission of the second resolution plan.

- April 19, 2018 : NCLT held that to determine eligibility, the date of commencement of the CIRP of ESIL i.e. August 2, 2017 should have been seen. It was held that the committee of creditors of ESIL (“COC”) and RP did not follow due procedure while rejecting the bids of ArcelorMittal and Numetal. The RP and COC were directed to give an opportunity to both the bidders to remove their disability by paying the overdue amounts.

- May 8, 2018 : The COC found both ArcelorMittal and Numetal ineligible. COC held that in order to be considered eligible, both the bidders should pay the overdue amounts and interest pertaining to the NPAs of their related corporate debtors.

- September 7, 2018 : NCLAT pronounced its order in the appeal filed against the order of NCLT. NCLAT held the following:

- At the time of submission of the first resolution plan on February 12, 2018, Numetal was not eligible under Section 29A as AEL (held by Rewant Ruia) was one of the shareholders of Numetal. However, at the time of submission of the second resolution plan on March 29, 2018, Numetal was eligible to submit a resolution plan as AEL was no longer a shareholder, and the remaining shareholders were eligible under Section 29A.

- AM Netherlands (a related party of ArcelorMittal) was the promoter of Uttam Galva on the date when Uttam Galva was classified as an NPA. Even though AM Netherlands sold its shares in Uttam Galva thereafter, it would continue to be ineligible till payment of all overdue amounts with interest and charges relating to NPA account of Uttam Galva is made. Further, LN Mittal Group (a connected person of ArcelorMittal) had been the promoter and in the management and control of KSS Petron since 2011. KSS Petron has been classified as an NPA by several banks. By merely selling all shares in KSS Petron, the ineligibility under Section 29A cannot be cured till payment of all overdue amounts with interest and charges relating to NPA account of KSS Petron is made.

Against the order of NCLAT, an appeal was filed before the SC.

What is Section 29A?

When the IBC was first enacted, it provided that any person could be a resolution applicant for submitting a resolution plan for the corporate insolvency resolution of a corporate debtor. No specific eligibility criteria were prescribed. This led to a situation where promoters of corporate debtors which had defaulted in payments (and were largely seen as being responsible for the downfall of the company) were bidding for the same corporate debtor at a discount. In order to prevent such promoters of defaulting companies from submitting resolution plans, the Government of India introduced an ordinance for amending the IBC on November 23, 2017 (“ Ordinance ”). The Ordinance introduced Section 29A setting out the eligibility criteria which must be satisfied in order for a person to be able to submit a resolution plan. The Ordinance was replaced by the Insolvency and Bankruptcy Code (Amendment) Act, 2018 on January 18, 2018 (“ First Amendment ”).

Section 29A as introduced by the First Amendment provided that a person will not be eligible to submit a resolution plan if such person or any other person acting jointly or in concert with such person or any connected person of such person fell within any of the criteria specified in Section 29A [7] .

Notably, pursuant to sub-section (c) of Section 29A, if a person has an account classified as an NPA or is in the management or control or a promoter of a company which has an account classified as an NPA, and if 1 year has lapsed from the date of such classification till the date of commencement of the CIRP of a corporate debtor, then such person is disqualified from submitting a resolution plan for the corporate debtor. In fact, as mentioned above, the person will also be disqualified if any other person acting jointly or in concert with such person or any connected person of such person has such an NPA account. This sub-section (c) has been the main focus of the Essar Steel Case [8] .

Section 29A underwent further changes subsequently pursuant to the Insolvency and Bankruptcy Code (Amendment) Ordinance, 2018 promulgated on June 6, 2018 as replaced by the Insolvency and Bankruptcy Code (Second Amendment) Act, 2018 (“ Second Amendment ”). As far as sub-section (c) of Section 29A is concerned, the said amendment, inter alia, replaced the words “has an account” with “at the time of submission of the resolution plan has an account”.

Section 29A(c) currently reads as follows:

“A person shall not be eligible to submit a resolution plan, if such person, or any other person acting jointly or in concert with such person –

(a) …

(b) …

(c) [at the time of submission of the resolution plan] [9] has an account, or an account of a corporate debtor under the management or control of such person or of whom such person is a promoter, classified as non-performing asset in accordance with the guidelines of the Reserve Bank of India issued under the Banking Regulation Act, 1949 (10 of 1949) or the guidelines of a financial sector regulator issued under any other law for the time being in force, and at least a period of one year has lapsed from the date of such classification till the date of commencement of the corporate insolvency resolution process of the corporate debtor:

Provided that the person shall be eligible to submit a resolution plan if such person makes payment of all overdue amounts with interest thereon and charges relating to nonperforming asset accounts before submission of resolution plan:

Provided further that nothing in this clause shall apply to a resolution applicant where such applicant is a financial entity and is not a related party to the corporate debtor.

Explanation I.- For the purposes of this proviso, the expression "related party" shall not include a financial entity, regulated by a financial sector regulator, if it is a financial creditor of the corporate debtor and is a related party of the corporate debtor solely on account of conversion or substitution of debt into equity shares or instruments convertible into equity shares, prior to the insolvency commencement date.

Explanation II.— For the purposes of this clause, where a resolution applicant has an account, or an account of a corporate debtor under the management or control of such person or of whom such person is a promoter, classified as non-performing asset and such account was acquired pursuant to a prior resolution plan approved under this Code, then, the provisions of this clause shall not apply to such resolution applicant for a period of three years from the date of approval of such resolution plan by the Adjudicating Authority under this Code;

(d) …”

Applying a 400-year-old principle of interpretation for interpreting Section 29A

The main issue in the Essar Steel Case revolved around whether ArcelorMittal and Numetal were eligible under Section 29A; specifically, under sub-section (c) [10] . Faced with deciding on this issue and interpreting Section 29A, SC adopted the principle of purposive interpretation of Section 29A, stating that the “text and the context in which the provision was enacted” should inform its interpretation. In doing so, SC (relying on an earlier decision in 2017 [11] ) moved away from the literal rule of interpretation to go back to a rule of interpretation laid down in an old English case [12] more than 400 years ago, according to which the Court must have recourse to the purpose, object, text and context of a particular provision before arriving at a judicial result.

A reading of the recent decisions of SC would indeed indicate that the pendulum is swinging towards a purposive method of interpretation from the literal rule of interpretation. However, the issue that arises is, when should purposive interpretation be adopted.

Recently, a Constitution Bench of SC [13] , called upon to interpret the meaning of ‘corrupt practices’ in the Representation of People Act, 1951, noted that if a statute is well-drafted and debated in Parliament, there is little or no need to adopt any interpretation other than a literal interpretation of the statute. However SC noted that, in a welfare State like ours, what is intended for the benefit of the people is not fully reflected in the text of a statute and in such legislations, a pragmatic view is required to be taken, and the law interpreted purposefully and realistically so that the benefit reaches the masses. In another matter, a Constitution Bench of SC [14] held that if a literal interpretation appears to be in any way in conflict with the legislative intent or is leading to absurdity, purposive interpretation will have to be adopted. SC also approved the observations that it is nowadays misleading to draw a rigid distinction between literal and purposive approaches.

In the Essar Steel Case, applying the principles of purposive interpretation, SC reasoned that Section 29A needs to be construed against the Statement of Objects and Reasons set out by the legislature while enacting the provision.

Section 29A comprises several elements, some of which are not defined or explained in the statute itself. For interpreting these elements, as discussed in the subsequent paragraphs, SC has correctly applied the principles of purposive interpretation.

Lifting the corporate veil

A company is a separate legal entity from its shareholders and it is settled law that the corporate veil of a company can be pierced to see the persons behind it only in limited circumstances. In the Essar Steel Case, SC held that when determining whether a company is eligible, considering the parameters in Section 29A, the corporate veil of the company has to be lifted to see the persons behind it.

After going through various precedents, SC held that the corporate veil of a company can be pierced in 3 situations: where a statute itself lifts the corporate veil, or where protection of public interest is of paramount importance, or where a company has been formed to evade obligations imposed by the law. SC extended this principle and held that this is to be applied even to group companies, so that one is able to look at the economic entity of the group as a whole.

Considering the purpose of Section 29A (i.e. to keep out undesirable persons from bidding as a resolution applicant), it is clear that the persons behind a resolution applicant have to be seen, and such persons (if otherwise ineligible) cannot be allowed to hide behind complex structuring. However, what is interesting in Section 29A is that, the way the section is drafted, perhaps even without lifting the corporate veil, it would be difficult for an otherwise ineligible person to hide behind a resolution applicant. This is because, the ineligibility criteria under Section 29A are required to be tested not only against the resolution applicant, but also against a wide gamut of persons, namely:

- persons acting jointly with the resolution applicant;

- persons acting in concert with the resolution applicant;

- connected persons of the resolution applicant [15] i.e.

- any person who is the promoter or in the management or control of the resolution applicant;

- any person who shall be the promoter or in management or control of the business of the corporate debtor during the implementation of the resolution plan;

- the holding company, subsidiary company, associate company and related party of any person who is the promoter or in the management or control of the resolution applicant [16] ; and

- the holding company, subsidiary company, associate company and related party of any person who shall be the promoter or in management or control of the business of the corporate debtor during the implementation of the resolution plan [17] .

In the Essar Steel Case, SC held that since Numetal itself relied entirely on the credentials of each of its constituent shareholders to satisfy the minimum tangible net worth requirement which was prescribed in the request for proposal, Numetal itself lifted its corporate veil; thereby the 4 entities who were shareholders of Numetal at the time of submission of the first resolution plan were acting jointly with Numetal. As mentioned above, under Section 29A, the eligibility of persons acting jointly or in concert with the resolution applicant is also required to be tested. SC has held that this is “a typical instance of a see through provision, so that one is able to arrive at persons who are actually in ‘control’, whether jointly, or in concert, with other persons”.

A question that may arise in future cases in light of SC’s observations on this matter is: Should shareholders of a resolution applicant be considered as acting jointly with the resolution applicant in all cases or only in cases such as Numetal (i.e. where a resolution applicant is newly incorporated and relies on its shareholders for satisfying the criteria under the request for proposals floated by the RP)?

SC also lifted the corporate veil while determining the eligibility of ArcelorMittal, and concluded that ultimately Mr. L.N. Mittal manages and controls ArcelorMittal, AM Netherlands (which was a promoter of Uttam Galva) and Fraseli (which was found to be in joint control of KSS Petron). Since, Uttam Galva and KSS Petron’s accounts were classified as NPAs by multiple banks atleast 1 year prior to the commencement of ESIL’s CIRP, hence ArcelorMittal was ineligible under Section 29A.

Meaning of acting “jointly” and in “concert”

The eligibility of persons acting jointly or in concert with the resolution applicant is required to be tested under Section 29A.

Acting jointly: SC once again adopted an expansive interpretation to hold that all that is to be seen by the expression “acting jointly” is whether certain persons have got together and are acting “jointly” in the sense of acting together and if this is made out on the facts, no super added element of “joint venture” is required to be seen.

Acting in concert: The meaning of ‘acting in concert’ is not explained in the IBC. SC therefore referred to the definition of ‘persons acting in concert’ in regulation 2(1)(q) of the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 (“ Takeover Regulations ”). As per the said definition, ‘persons acting in concert’ are persons who, with a common objective or purpose of acquisition of shares or voting rights in, or exercising control over a target company, pursuant to an agreement or understanding, formal or informal, directly or indirectly co-operate for acquisition of shares or voting rights in, or exercise of control over the target company. SC held that any understanding, even if it is informal, and even if it is to indirectly cooperate to exercise control over a target company, is included.

However, merely lifting the meaning of the term from the Takeover Regulations may not answer all questions.

What is important to note is that under the Takeover Regulations, the term ‘persons acting in concert’ has been defined in the context of persons acting in concert with the purpose of acquisition of shares or voting rights or exercising control over a target company. The question that arises is, when using the term in the context of Section 29A, what is the purpose that should be seen.

In its judgment, SC has not expressly mentioned that persons would be deemed to be acting in concert for the purposes of Section 29A if they are acting for a specific purpose. SC appears to have favoured a broader interpretation and has held that the language evinces an intention to rope in all persons who may be acting in concert with the person submitting a resolution plan (paragraph 28). SC has also observed that wherever persons act jointly or in concert with the ‘person’ who submits a resolution plan, all such persons are covered by Section 29A (paragraph 39). A reading of paragraphs 29 and 54 of the judgement may however indicate that the purpose to be seen is the purpose of submitting a resolution plan [18] .

SC has also clarified that a fortuitous relationship coming into existence by accident or chance cannot amount to “persons acting in concert”.

The De Jure Test while interpreting the expression “management”

In its judgment, SC also delved into the meaning of the word ‘management’. As mentioned above, under Section 29A(c), a person is, inter alia, ineligible if such person has an account of a corporate debtor, which is under the management of such person, and which is classified as an NPA for atleast 1 year [19] .

While interpreting Section 29A(c), SC has held that the expression ‘management’ would refer to the de jure management of a corporate debtor which would ordinarily vest in a board of directors, and would include, ‘manager’, ‘managing director’ and ‘officer’ as defined in the Companies Act, 2013.

‘De jure’ is a Latin phrase meaning ‘by law’, ‘as a matter of law’ etc. [20] and is in contradiction to the phrase ‘de facto’ which means ‘in fact, in reality, in actual existence, force or possession as a matter of fact’ [21] .

Though SC has interpreted the expression ‘management’ in the context of Section 29A(c), it would be interesting to see whether the same meaning would be attached when interpreting the expression as used in the definition of ‘connected person’ in Explanation I to Section 29A. As per the definition of a ‘connected person’, a person who is in the management of a resolution applicant is deemed to be a connected person of the resolution applicant, and accordingly if such person is ineligible under any of the provisions of Section 29A, then the resolution applicant would become ineligible. If the de jure test is applied, then all directors on the board of directors of a resolution applicant (including independent directors and nominee directors who may not be in the day-to-day management of the resolution applicant) would have to pass the test of Section 29A; and this would also mean that all related parties of such directors would be tested against Section 29A. The definition of a ‘related party’ is reproduced in Annexure B.

Meaning of “control”

Under Section 29A(c), a person is, inter alia, ineligible if such person has an account of a corporate debtor, which is under the control of such person, and which is classified as an NPA for atleast 1 year [22] .

The expression ‘control’ is not defined in the IBC. SC referred to the definition of ‘control’ in the Companies Act, 2013 to interpret the expression. The definition in the Companies Act, 2013 is as follows:

Control shall include the right to appoint majority of the directors or to control the management or policy decisions exercisable by a person or persons acting individually or in concert, directly or indirectly, including by virtue of their shareholding or management rights or shareholders agreements or voting agreements or in any other manner.

SC held that the first part of the definition i.e. the right to appoint majority of the directors refers to de jure control. The second part of the definition refers to de facto control. Importantly, SC held that the expression ‘control’, in Section 29A(c), denotes only positive control, “which means that the mere power to block special resolutions of a company cannot amount to control”.

While holding that ‘control’ in Section 29A(c) would mean positive control and not negative control, SC also relied on the expression ‘under’ in the phrase ‘under the management or control of such person’ appearing in Section 29A(c), stating that the expression ‘under’ would seem to suggest positive or proactive control, as opposed to mere negative or reactive control.

Interestingly, though the expression ‘under’ is used for both ‘management’ and ‘control’, SC held that ‘control’ would mean de jure or de facto proactive or positive control of actual management or policy decisions that can be or are in fact taken; whereas as discussed above, the expression ‘management’ has been interpreted to mean de jure management.

One may be tempted to apply the interpretation adopted by SC, while interpreting the meaning of ‘control’ under the Takeover Regulations. In fact, SC seems to have even approved the observation of the Securities Appellate Tribunal in a case under the Takeover Regulations where it was held that control means positive control [23] . However, SC has also indicated that ‘control’ may include ‘negative control’ from “an expansive reading of the definition of the word “control” contained in Section 2(27) of the Companies Act, 2013, which is inclusive and not exhaustive in nature”. The definition of ‘control’ in the Takeover Regulations is similar to the one in the Companies Act, 2013. Hence, what would constitute control for the purposes of the Takeover Regulations, would depend on the facts and is a question which is open.

The expression ‘control’ was relevant in the Essar Steel Case to, inter alia, determine whether Fraseli, a company managed and controlled by Mr. L.N. Mittal, and holding one-third of the shares in KSS Global, which in turn held 100% of the share capital in KSS Petron, was in joint control of KSS Petron (which is an NPA account). SC held that if the corporate veils of all these companies were disregarded, Fraseli would be found to be in joint control of KSS Petron. In reaching this conclusion, SC relied on the shareholding of Fraseli in KSS Global (which was about one-third of the total capital), and a shareholders agreement which granted Fraseli the right to appoint an equal number of directors as the other 2 shareholders of KSS Global and also granted Fraseli affirmative voting rights. SC held that this would show that a group company of Mr. L.N. Mittal exercised positive control over KSS Global which in turn held 100% shareholding in KSS Petron.

The judgment does not elaborate on the nature of affirmative voting rights which were enjoyed by Fraseli, but interestingly, from NCLT’s order it appears that the lawyers from the RP had opined that Fraseli had negative control. Hence, perhaps, even for the purposes of Section 29A(c), what constitutes ‘control’ can still be subject to debate.

Finally, ArcelorMittal was found to be ineligible under Section 29A(c) by SC since: (i) KSS Petron was classified as an NPA account, (ii) Fraseli was found to be in joint control of KSS Petron on the grounds described above, (iii) Fraseli was found to be managed and controlled by Mr. L.N. Mittal, and (iii) Mr. L.N. Mittal is the ultimate shareholder of ArcelorMittal.

Test of ‘reasonable proximate state of affairs’ and reference date for determining eligibility

One major issue decided by SC is whether the eligibility of a resolution applicant under Section 29A(c) should be determined as on the date when a resolution plan is submitted or as on the date when the CIRP of a corporate debtor commences. Earlier NCLT had indicated that it should apply when the CIRP of a corporate debtor commences.

SC settles this question by categorically stating that “the stage of ineligibility attaches when the resolution plan is submitted by a resolution applicant”. The implication of this is that on the date when a resolution plan is submitted, the resolution applicant or any person acting jointly or in concert with the person or any connected person of the resolution applicant should not have an account classified as an NPA [24] . Also such person should not be in the management or control of a corporate debtor or be a promoter of a person which has an NPA account.

However, though SC categorically states that the date of submission of a resolution plan is required to be seen to determine eligibility, SC introduces the test of ‘reasonable proximate state of affairs’ to determine the date on which ineligibility attaches. According to this test, antecedent facts reasonably proximate to the time of submission of a resolution plan can be seen to determine eligibility. SC has clarified that it has to be seen on the facts of a case as to whether at a reasonably proximate point of time before the submission of a resolution plan, a person arranges its affairs with the intention to avoid paying off the debts of NPA account before submitting a plan (as is required under Section 29A). In such a case, the person would be held ineligible unless the person pays off such dues. In doing so SC adopts the principle of purposive interpretation.

The following observations in the judgment are important:

“It is important for the competent authority to see that persons, who are otherwise ineligible and hit by sub-clause (c), do not wriggle out of the proviso to sub-clause (c) by other means, so as to avoid the consequences of the proviso. For this purpose, despite the fact that the relevant time for the ineligibility under subclause (c) to attach is the time of submission of the resolution plan, antecedent facts reasonably proximate to this point of time can always be seen, to determine whether the persons referred to in Section 29A are, in substance, seeking to avoid the consequences of the proviso to sub-clause (c) before submitting a resolution plan. If it is shown, on facts, that, at a reasonably proximate point of time before the submission of the resolution plan, the affairs of the persons referred to in Section 29A are so arranged, as to avoid paying off the debts of the non-performing asset concerned, such persons must be held to be ineligible to submit a resolution plan, or otherwise both the purpose of the first proviso to sub-section (c) of Section 29A, as well as the larger objective sought to be achieved by the said sub-clause in public interest, will be defeated.” (emphasis added)

SC held that “great care must be taken to ensure that persons who are in charge of the corporate debtor for whom such resolution plan is made, do not come back in some other form to regain control of the company without first paying off its debts”. A person can no longer adopt innovative structuring to escape the provisions of Section 29A(c).

Intent of a resolution applicant therefore becomes important. If a resolution applicant restructures its affairs only to escape the provisions of Section 29A, then the ineligibility would apply. The Essar Steel Case is a perfect example of this:

- In ArcelorMittal’s case, SC found that AM Netherland’s shares in Uttam Galva were sold only in order to get out of the ineligibility mentioned by Section 29A(c). Similarly in the case of KSS Petron it was found that shares were sold and nominee directors resigned reasonably proximate to the date of submission of the resolution plan.

- In case of Numetal, though AEL (Rewant Ruia’s company) exited Numetal completely before the submission of its second resolution plan in April 2018, SC applied the test of ‘reasonable proximate state of affairs’ to hold Numetal ineligible because “having regard to the reasonably proximate state of affairs before submission of the resolution plan on 2.4.2018, beginning with Numetal’s initial corporate structure, and continuing with the changes made till date, it is evident that, the object of all the transactions that have taken place after Section 29A came into force on 23.11.2017 is undoubtedly to avoid the application of Section 29A(c), including its proviso”. Hence, though as on the date of submission of its second resolution plan, Numetal was technically not ineligible under Section 29A, however, SC considered Numetal’s shareholders and other affairs at a time reasonably proximate to the time of submission of a resolution plan to hold Numetal ineligible. SC also took note of the fact that an earnest money of Rs. 500 crores which was deposited by AEL continued to remain deposited even as on the date of submission of the second resolution plan. SC thus found Rewant Ruia’s ‘looming presence’ all along.

Another reason to support a purposive interpretation of Section 29A(c), though not discussed in the judgment, is the language of the proviso to the said sub-section. The proviso essentially states that if a resolution applicant is found to be ineligible by virtue of Section 29A(c), then such person can cure the ineligibility by paying off all overdue amounts with interest thereon and charges relating to the NPA before submission of a resolution plan. Hence, the proviso requires one to examine a person’s eligibility before submission of a resolution plan and categorically states that the only way to cure such ineligibility is by paying off the dues before submission of a resolution plan. Therefore, one may argue that though under sub-section (c) it has to be seen whether on the date of submission of a resolution plan, a person is eligible, however, facts antecedent to the date of submission are also relevant.

Speed is of essence

SC has unequivocally stated that the time period set out in the IBC for completion of CIRP is mandatory. It has to be completed within a period of 180 days from the date of admission of the application. This time period is extendable by a maximum period of 90 days only if the committee of creditors, by a vote of 66%, votes to extend the said period, and only if the adjudicating authority is satisfied that such process cannot be completed within 180 days. Such extension cannot be granted more than once. SC has also clarified that the period of time taken in litigation ought to be excluded “where a resolution plan is upheld by the Appellate Authority, either by way of allowing or dismissing an appeal before it”.

SC also held that it is of utmost importance for all authorities concerned to follow the model timeline prescribed in the Insolvency and Bankruptcy Board of India (Insolvency Resolution Process for Corporate Persons) Regulations, 2016 as closely as possible.

Challenging a CIRP

One of the most important facets of SC’s judgment is the observations regarding challenges to a CIRP by a resolution applicant.

Section 60(5)(c) of the IBC states that notwithstanding anything to the contrary contained in any other law for the time being in force, NCLT shall have jurisdiction to entertain or dispose of any question of priorities or any question of law or facts, arising out of or in relation to the insolvency resolution or liquidation proceedings of the corporate debtor or corporate person under the IBC. At first brush, this section appears to vest the NCLT with broad powers without any limitation as to when it can entertain applications. However, in rendering its judgment on this issue, SC seems to have adopted a narrow interpretation of section 60(5)(c) of the IBC.

The key points which emerge from the judgment are as follows:

- If a resolution plan is turned down at the threshold by an RP under section 30(2) of the IBC (i.e. if the RP finds that a resolution plan does not meet the requirements specified under the said section [25] ), then no challenge can be preferred at this stage, whether to the adjudicating authority or a High Court.

- If, after a resolution plan is presented before the committee of creditors, the committee of creditors does not approve such a plan after considering its feasibility and viability, no application can be made before an adjudicating authority.

- If the committee of creditors disapproves a resolution plan on the ground that it violates the provisions of any law, including the ground that a resolution plan is ineligible under Section 29A, the adjudicating authority can determine the issue, after which an appeal can be preferred to the appellate authority.

- If the committee of creditors approves a resolution plan which is thereafter approved by the adjudicating authority, such approval can be challenged before the appellate authority.

- When section 60(5) of the IBC speaks of the NCLT having jurisdiction to entertain or dispose of any application or proceeding by or against the corporate debtor or corporate person, it does not invest the NCLT with the jurisdiction to interfere at an applicant’s behest at a stage before the quasi-judicial determination made by the adjudicating authority.

A resolution applicant’s ability to challenge the various processes has therefore been curtailed or rather deferred. The intent of the judgment is clear in as much as the entire process from the date of commencement of CIRP until approval or rejection of a resolution plan by the committee of creditors and determination by NCLT, should be completed without any challenges by a resolution applicant. Hence, an unsuccessful resolution applicant would have to wait till the entire process is complete. If this principle was to be applied to the Essar Steel Case, then both Numetal and ArcelorMittal would have to wait till the COC would have taken a decision in the third round of bidding and the matter was before NCLT (unless COC decided to go in for a fourth round of bidding, then after a decision was taken in such subsequent round).

Role of the Resolution Professional

The RP plays a central role in a CIRP. However, what exactly is the nature of the RP’s role and duties has been a matter of much debate.

Earlier NCLT had held that the nature of duties assigned to an RP is similar to a public servant and can be termed as an instrumentality of the State. Further, it was held that as an instrumentality of the State, the RP has to act in a transparent and fair manner and not take arbitrary decisions or adopt a discriminatory practice.

If the RP is considered an instrumentality of the State, then it would have significant consequences. The RP would be amenable to the writ jurisdiction of the High Court and SC i.e. a person can file a writ petition against the decision of the RP. However, in the Essar Steel Case not only did the SC make no such observation, as mentioned above, SC held that if the RP turns down a resolution plan determining that it does not comply with section 30(2), a challenge cannot even be preferred at this stage to the adjudicating authority as a resolution applicant has no vested right that his resolution plan be considered.

Importantly, SC has held that a RP is not required to take any decision on the issue of whether a resolution plan is in accordance with the conditions prescribed under the IBC. According to the judgment, the RP is only required to ensure that a resolution plan is complete in all respects. In light of these observations, a question arises as to whether, while examining a resolution plan under section 30(2) of the IBC, the RP exercises a quasi-judicial function which is appealable and where a right of hearing has to be mandatorily provided? In this regard a reference may be made to the decision of the SC in the case of Competition Commission of India v. Steel Authority of India Limited [26] (“CCI Case”). In the CCI Case, SC had held that when the Competition Commission of India forms an opinion about the existence of a prima facie case for contravention of certain provisions of the Competition Act, 2002 and passes a direction to the Director General to cause an investigation into the matter, it is an administrative direction without entering upon any adjudicatory process and does not effectively determine any right or obligation of the parties to the lis. Such a decision is not appealable and also in such cases a right of hearing is not contemplated.

The matter has certainly not concluded and the question that remains to be asked is what next? SC has categorically held that both Numetal and ArcelorMittal would have to pay off the NPAs of their respective corporate debtors within 2 weeks before their resolution plans are considered. For Numetal, this would include dues of ESIL as well as other Ruia group companies and is expected to be an amount in excess of Rs. 50,000 crores. The COC will then have a period of 2 months to consider their resolution plans and that of Vedanta Resources Limited.

Interestingly, SC has made it clear “that in the event that no plan is found worthy of acceptance by the requisite majority of the Committee of Creditors, the corporate debtor, i.e. ESIL, shall go into liquidation”. This effectively means that during the next 2 months, COC may not be able to invite fresh resolution plans should it decide that the existing bids will not result in maximization of value or are not feasible and viable, unless it seeks a clarification from SC. SC’s judgment also seems to indicate that the COC will have to consider only the resolution plans submitted on April 2, 2018, thereby effectively preventing a new bidder from entering the race. This is where another debate on process v. maximization of value may begin, and for that one would have to wait for the decision of SC in another matter !

This paper has been contributed by Adity Chaudhury, Partner.

Section 29A

29A. Persons not eligible to be resolution applicant

A person shall not be eligible to submit a resolution plan, if such person, or any other person acting jointly or in concert with such person--

- is an undischarged insolvent;

- is a wilful defaulter in accordance with the guidelines of the Reserve Bank of India issued under the Banking Regulation Act, 1949 (10 of 1949);

- at the time of submission of the resolution plan has an account, or an account of a corporate debtor under the management or control of such person or of whom such person is a promoter, classified as non-performing asset in accordance with the guidelines of the Reserve Bank of India issued under the Banking Regulation Act, 1949 (10 of 1949) or the guidelines of a financial sector regulator issued under any other law for the time being in force, and at least a period of one year has lapsed from the date of such classification till the date of commencement of the corporate insolvency resolution process of the corporate debtor:

Provided that the person shall be eligible to submit a resolution plan if such person makes payment of all overdue amounts with interest thereon and charges relating to non-performing asset accounts before submission of resolution plan;

Explanation I.-- For the purposes of this proviso, the expression "related party" shall not include a financial entity, regulated by a financial sector regulator, if it is a financial creditor of the corporate debtor and is a related party of the corporate debtor solely on account of conversion or substitution of debt into equity shares or instruments convertible into equity shares, prior to the insolvency commencement date.

Explanation II.-- For the purposes of this clause, where a resolution applicant has an account, or an account of a corporate debtor under the management or control of such person or of whom such person is a promoter, classified as non-performing asset and such account was acquired pursuant to a prior resolution plan approved under this Code, then, the provisions of this clause shall not apply to such resolution applicant for a period of three years from the date of approval of such resolution plan by the Adjudicating Authority under this Code;

- has been convicted for any offence punishable with imprisonment--

- for two years or more under any Act specified under the Twelfth Schedule; or

- for seven years or more under any other law for the time being in force:

Provided that this clause shall not apply to a person after the expiry of a period of two years from the date of his release from imprisonment:

Provided further that this clause shall not apply in relation to a connected person referred to in clause (iii) of Explanation I;

- is disqualified to act as a director under the Companies Act, 2013 (18 of 2013);

Provided that this clause shall not apply in relation to a connected person referred to in clause (iii) of Explanation I;

- is prohibited by the Securities and Exchange Board of India from trading in securities or accessing the securities markets;

- has been a promoter or in the management or control of a corporate debtor in which a preferential transaction, undervalued transaction, extortionate credit transaction or fraudulent transaction has taken place and in respect of which an order has been made by the Adjudicating Authority under this Code;

Provided that this clause shall not apply if a preferential transaction, undervalued transaction, extortionate credit transaction or fraudulent transaction has taken place prior to the acquisition of the corporate debtor by the resolution applicant pursuant to a resolution plan approved under this Code or pursuant to a scheme or plan approved by a financial sector regulator or a court, and such resolution applicant has not otherwise contributed to the preferential transaction, undervalued transaction, extortionate credit transaction or fraudulent transaction;

- has executed a guarantee in favour of a creditor in respect of a corporate debtor against which an application for insolvency resolution made by such creditor has been admitted under this Code and such guarantee has been invoked by the creditor and remains unpaid in full or part;

- is subject to any disability, corresponding to clauses (a) to (h), under any law in a jurisdiction outside India; or

- has a connected person not eligible under clauses (a) to (i).

Explanation I.-- For the purposes of this clause, the expression "connected person" means--

- any person who is the promoter or in the management or control of the resolution applicant; or

- any person who shall be the promoter or in management or control of the business of the corporate debtor during the implementation of the resolution plan; or

- the holding company, subsidiary company, associate company or related party of a person referred to in clauses (i) and (ii):

Provided that nothing in clause (iii) of Explanation I shall apply to a resolution applicant where such applicant is a financial entity and is not a related party of the corporate debtor:

Provided further that the expression "related party" shall not include a financial entity, regulated by a financial sector regulator, if it is a financial creditor of the corporate debtor and is a related party of the corporate debtor solely on account of conversion or substitution of debt into equity shares or instruments convertible into equity shares, prior to the insolvency commencement date;

Explanation II.-- For the purposes of this section, "financial entity" shall mean the following entities which meet such criteria or conditions as the Central Government may, in consultation with the financial sector regulator, notify in this behalf, namely:--

- a scheduled bank;

- any entity regulated by a foreign central bank or a securities market regulator or other financial sector regulator of a jurisdiction outside India which jurisdiction is compliant with the Financial Action Task Force Standards and is a signatory to the International Organisation of Securities Commissions Multilateral Memorandum of Understanding;

- any investment vehicle, registered foreign institutional investor, registered foreign portfolio investor or a foreign venture capital investor, where the terms shall have the meaning assigned to them in regulation 2 of the Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations, 2017 made under the Foreign Exchange Management Act, 1999 (42 of 1999);

- an asset reconstruction company registered with the Reserve Bank of India under section 3 of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (54 of 2002);

- an Alternate Investment Fund registered with the Securities and Exchange Board of India;

- such categories of persons as may be notified by the Central Government.

Related Party

5 (24) “Related party”, in relation to a corporate debtor, means -

- a director or partner of the corporate debtor or a relative of a director or partner of the corporate debtor;

- a key managerial personnel of the corporate debtor or a relative of a key managerial personnel of the corporate debtor;

- a limited liability partnership or a partnership firm in which a director, partner, or manager of the corporate debtor or his relative is a partner;

- a private company in which a director, partner or manager of the corporate debtor is a director and holds along with his relatives, more than two per cent. of its share capital;

- a public company in which a director, partner or manager of the corporate debtor is a director and holds along with relatives, more than two per cent. of its paid- up share capital;

- anybody corporate whose board of directors, managing director or manager, in the ordinary course of business, acts on the advice, directions or instructions of a director, partner or manager of the corporate debtor;

- any limited liability partnership or a partnership firm whose partners or employees in the ordinary course of business, acts on the advice, directions or instructions of a director, partner or manager of the corporate debtor;

- any person on whose advice, directions or instructions, a director, partner or manager of the corporate debtor is accustomed to act;

- a body corporate which is a holding, subsidiary or an associate company of the corporate debtor, or a subsidiary of a holding company to which the corporate debtor is a subsidiary;

- any person who controls more than twenty per cent. of voting rights in the corporate debtor on account of ownership or a voting agreement;

- any person in whom the corporate debtor controls more than twenty per cent of voting rights on account of ownership or a voting agreement;

- any person who can control the composition of the board of directors or corresponding governing body of the corporate debtor;

- participation in policy making processes of the corporate debtor; or

- having more than two directors in common between the corporate debtor and such person; or

- interchange of managerial personnel between the corporate debtor and such person; or

- provision of essential technical information to, or from, the corporate debtor.

5 (24A) “Related party”, in relation to an individual, means –

- a person who is a relative of the individual or a relative of the spouse of the individual;

- a partner of a limited liability partnership, or a limited liability partnership or a partnership firm, in which the individual is a partner;

- a person who is a trustee of a trust in which the beneficiary of the trust includes the individual, or the terms of the trust confers a power on the trustee which may be exercised for the benefit of the individual;

- a private company in which the individual is a director and holds along with his relatives, more than two per cent. of its share capital;

- a public company in which the individual is a director and holds along with relatives, more than two per cent. of its paid-up share capital;

- a body corporate whose board of directors, managing director or manager, in the ordinary course of business, acts on the advice, directions or instructions of the individual;

- a limited liability partnership or a partnership firm whose partners or employees in the ordinary course of business, act on the advice, directions or instructions of the individual;

- a person on whose advice, directions or instructions, the individual is accustomed to act;

- a company, where the individual or the individual along with its related party, own more than fifty per cent. of the share capital of the company or controls the appointment of the board of directors of the company.

Explanation. - For the purposes of this clause, - (a) “relative”, with reference to any person, means anyone who is related to another, in the following manner, namely:-

- members of a Hindu Undivided Family,

- son’s daughter and son,

- daughter’s daughter and son,

- grandson’s daughter and son,

- granddaughter’s daughter and son,

- brother’s son and daughter,

- sister’s son and daughter,

- father’s father and mother,

- mother’s father and mother,

- father’s brother and sister,

- mother’s brother and sister; and

(b) wherever the relation is that of a son, daughter, sister or brother, their spouses shall also be included.

Adity Chaudhury

[1] Section 62 of the IBC.

[2] Chitra Sharma v. Union of India , 2018(9) SCALE 490.

[3] Justice Chandrachud held: “ We must particularly be careful not to supplant the mechanisms which have been laid down in the IBC by substituting them with a mechanism under judicial directions. Such a course of action would in our view not be consistent with the need to ensure complete justice under Article 142, under the regime of law.”

[4] ArcelorMittal India Private Limited v. Satish Kumar Gupta , Civil Appeal Nos. 9402 – 9405 of 2018, decided on October 4, 2018.

[6] The facts are based on information available in public domain and have not been factually verified.

[7] Section 29A is reproduced in Annexure A for ease of reference.

[8] Though SC’s judgment also deal with certain other sub-sections of Section 29A, this paper focuses mainly on the interpretation of sub-section (c).

[9] Inserted by the Second Amendment.

[10] Though SC’s judgment also deal with certain other sub-sections of Section 29A, this paper focuses mainly on the interpretation of sub-section (c).

[11] Ms. Eera Through Dr. Manjula Krippendorf v. State , (2017) 15 SCC 133.

[12] Heydon case , (1584) 3 Co Rep 7a : 76 ER 637.

[13] Abhiram Singh v. C.D. Commachen (Dead) by L.Rs. , (2017)2 SCC 629.

[14] Sarah Mathew v. Institute of Cardio Vascular Diseases by its Director K.M. Cherian , (2014)2 SCC 62.

[15] Defined in Explanation I to Section 29A.

[16] This will not apply to a financial entity which is not a related party of the corporate debtor.

[18] In paragraph 54, SC has held that as per the interpretation of Section 29A(c), any person who wishes to submit a resolution plan, if he or it does so acting jointly, or in concert with other persons, which person or other persons happen to either manage or control or be promoters of a corporate debtor, who is classified as a NPA and whose debts have not been paid off for a period of at least one year before commencement of the CIRP, becomes ineligible to submit a resolution plan.

In paragraph 29 of the judgment, SC has held that “it is important to discover in such cases as to who are the real individuals or entities who are acting jointly or in concert, and who have set up such a corporate vehicle for the purpose of submission of a resolution plan ” .

[19] Please refer to Annexure A, for the entire Section 29A.

[20] Vasant Rao v. Farooq-Ali , 1995(3) ALT 1 (Andhra Pradesh High Court).

[21] Rajasekhar v. Siddalingappa , ILR 1986 Karnataka 2765 .

[22] Please refer to Annexure A, for the entire Section 29A.

[23] Subhkam Ventures (I) Private Limited v. The Securities and Exchange Board of India , Appeal No. 8 of 2009 decided on January 15, 2010.

[24] Section 29A(c) also states that such person will be ineligible if he or it has an account, or an account of a corporate debtor under the management or control of such person or of whom such person is a promoter, classified as an NPA in accordance with the guidelines of the Reserve Bank of India issued under the Banking Regulation Act, 1949 or the guidelines of a financial sector regulator issued under any other law for the time being in force, and at least a period of 1 year has lapsed from the date of such classification till the date of commencement of the CIRP of the corporate debtor.

[25] Under section 30(2) of the IBC, the RP has to examine that the resolution plans received by the RP conform to the requirements prescribed, which are as follows:

- A resolution plan should provide for payment of insolvency resolution process costs in a manner specified by the Board in priority to the payment of other debts of the corporate debtor;

- a resolution plan should provide for the payment of the debts of operational creditors in such manner as may be specified by the Board which shall not be less than the amount to be paid to the operational creditors in the event of a liquidation of the corporate debtor under section 53;

- a resolution plan should provide for the management of the affairs of the corporate debtor after approval of the resolution plan;

- a resolution plan should provide for the implementation and supervision of the resolution plan;

- a resolution plan should not contravene any of the provisions of the law for the time being in force; and

- a resolution plan should confirm to such other requirements as may be specified by the Board.

[26] Competition Commission of India v. Steel Authority of India Limited , (2010)10 SCC 744.

Our Offices

11, 1st Floor, Free Press House 215, Nariman Point Mumbai – 400021

+91 22 67362222

7A, 7th Floor, Tower C, Max House, Okhla Industrial Area, Phase 3, New Delhi – 110020

+91 11 6904 4200

68 Nandidurga Road Jayamahal Extension Bengaluru – 560046

+91 80 46462300

Binoy Bhavan 3rd Floor, 27B Camac Street Kolkata – 700016

+91 33 40650155/56

The rules of the Bar Council of India do not permit advocates to solicit work or advertise in any manner. This website has been created only for informational purposes and is not intended to constitute solicitation, invitation, advertisement or inducement of any sort whatsoever from us or any of our members to solicit any work in any manner. By clicking on 'Agree' below, you acknowledge and confirm the following:

a) there has been no solicitation, invitation, advertisement or inducement of any sort whatsoever from us or any of our members to solicit any work through this website;

b) you are desirous of obtaining further information about us on your own accord and for your use;

c) no information or material provided on this website is to be construed as a legal opinion and use of this website will not create any lawyer-client relationship;

d) while reasonable care has been taken in ensuring the accuracy of the contents of the website, Argus Partners shall not be responsible for the results of any actions taken on the basis of information provided in this website or for any error or omission in the website; and

e) in cases where the user has any legal issues, the user must seek independent legal advice.

- Follow us on :

- PERSONAL FINANCE

- REAL ESTATE

- LEADERS OF TOMORROW

- Financial Reports

- Weight Loss

- Men's Fashion

- Women's Fashion

- Urban Debate

- Baking Recipes

- Breakfast Recipes

- Foodie Facts

- Healthy Recipes

- Seasonal Recipes

- Starters & Snacks

- Car Reviews

- Bike Reviews

- Cars First Look

- Bikes First Look

- Bike Comparisons

- Car Comparisons

- India Upfront

- Bollywood Fashion & Fitness

- Movie Reviews

- Planning & Investing

- Real Estate

- Inspiration Inc

- Cricket News

- ASIA CUP 2018

- Comparisons

- Business News >

Youngest Essar scion prepares $6bn all-cash bid to retain family steel biz

The report adds that an all-cash offer is likely to attract more attention for the lenders as competing offers are expected to have less cash component..

Mumbai : Essar co-founder Ravi Ruia's son is all set to bid $6 billion in cash to retain the family steel business. It has been learnt that a consortium, led the youngest Essar scion Rewant Ruia, is set to make an all-cash offer of $5-6 billion (approximately Rs 33,000 crore to Rs 40,000 crore) in order to retain Essar Steel. Nu Metal Corporation, led by the Rewant Ruia and backed by Russia's VTB as the largest stakeholder (40%), faces stiff competition in the bidding process from Arcelor Mittal and Nippon Steel, reports The Times of India.